Episode Transcript

[00:00:03] Speaker A: If you believe the forecast, 2025 was set to be a rough ride for air cargo. Funny thing is hasn't quite played out like that.

[00:00:12] Speaker B: So when people say, well, this is going to stop trade, that's not my experience.

It has not stopped.

[00:00:17] Speaker C: Our cargo volumes have actually grown this year.

[00:00:19] Speaker D: Overall, I think the picture is relatively optimistic.

[00:00:23] Speaker E: We're expecting continued growth going into 2026.

[00:00:26] Speaker F: But I think obviously the geopolitical issues are still out there.

[00:00:30] Speaker C: E commerce will continue to grow and that's really going to help fuel growth for the entire aviation industry.

[00:00:37] Speaker G: You are listening to the Freight Buyers Club. This podcast is brought to you by your host Mike King and produced in partnership with Demurco Express Group, a global 3 PL that specializes in managing logistics to from and within the Asia Pacific region.

[00:00:52] Speaker A: Hello, welcome to the Freight Buyers Club. This air cargo special is produced with the support of Demerco Express Group. And today we're asking a simple question.

Is air cargo actually doing better than almost everyone expected?

Because whisper it, some of the numbers suggest the floor isn't quite falling away after all. For all the headwinds air cargo has faced this year, in mid November, the Baltic Air Freight Index was which reflects spot air cargo rates on global lanes was 2.4% higher than a year earlier. In fact, if you go back to the end of last year, as you can see on video here, courtesy of TAC Index on freight pricing, at least as we build up to the traditional Q4 peak season and the peak on rates in 2024 came in December 2025 doesn't look a whole lot different to a year and a half earlier.

Where this spike ends we don't yet know. Of course, now breaking that down a little more because this is where the picture gets really interesting. The Shanghai Pudong Outbound Air Freight index was up 4.5% in mid November compared to a year earlier. Spot rates from China to Europe were softer, but we're talking single digit drops and volumes are rising too.

So if this turns out to be a soft landing or just an underwhelming peak, it's still far better than most people forecast. But before we get carried away, let's rewind a bit.

Because in 2025, context is everything. And that context starts here. The White House's Liberation Day.

[00:02:38] Speaker F: My fellow Americans, this is Liberation Day.

April 2, 2025.

[00:02:47] Speaker A: When analysts and industry veterans peered into their crystal balls this year, US Policy overshadowed everything. And nobody captured that mood better than Sean Dolan, CEO of NorthLink Aviation.

[00:02:58] Speaker D: So a lot of concern in the industry Coming into the first quarter with the change in administration and the prospect for tariffs and the end of de minimis. And all of those concerns were realized to a large degree with a lot of tariffs and the end of de minimis, especially between the US And China at the end of May.

[00:03:18] Speaker A: And those headwinds generated by Washington created a trading environment was, well, let's call it character Building tariffs on, tariffs off, shifting rules and the sudden end of de minimis exemptions left shippers and forwarders trying to read a rule book that kept updating itself. This was trade policy as hard geopolitical power, something of our industry hasn't really had to deal with for decades. GLYN Hughes Director General of TIAKA so.

[00:03:45] Speaker E: Earlier this year, there was a lot of concern in the industry about the potential volatility, particularly here in the US with the US or the 47th presidential administration illustrating or certainly indicating prior to taking office that it intended to effectively rewrite the global trading environment.

And we saw progressively over the first few months, tariffs on tariffs off the so called Liberation Day with the listed tariffs which were quite extreme, there was a lot of front loading prior to some of the tariffs being implemented. There was a lot of horse trading in that context where tariffs were actually deferred. We saw that a lot with China. So it was really being utilized as a negotiating tactic, almost the weaponization of trade. So to negotiate more preferential situations, there was the threat of tariffs and other barriers coming in that would restrict the free throwing of trade.

[00:04:38] Speaker A: For the people managing the day to day reality of US and imports and exports, few felt those shocks more directly than customs brokers. Andrea Nicole Wilson is Customs VP at the Florida Custom Brokers and Forwarders association. But she's speaking here to the Freight Buyers Club in a private capacity.

[00:04:55] Speaker B: So what are the challenges we faced this year? Quite a few of them. But as a customs broker and dealing directly and very closely with freight forwarders and logistics is the change, the rapid change of regulations.

So there is very little time to get familiar with the regulations. We have rules that were passed, you know, three hours before they were implemented. So as customs brokers, it is our job to understand these regulations correctly. So that's been a challenge. I think the systems that we use to communicate with customs sometimes lag because the changes can't be done that quick. But I think all in all, the biggest change is compliance.

Everything is going through a lot more security, a lot more scrutiny. We have to make sure that we're vetting our customers correctly. So for me, as a customs Broker. That's been the biggest challenge that our job multiplied by four now because there's so many aspects that we have to look into and so many relations that we need to understand fully. And that changes every day. Changes duties per country, duties for steel, duties for car parts, you know, heavy duty, non duty. There's just so much to assimilate and take in. So that's been the biggest challenge.

[00:06:07] Speaker A: And that constant chain has had real world consequences for shippers, retailers and manufacturers across the U.S. one of the biggest.

[00:06:15] Speaker B: Problems that I've seen a few of my importers run into is they bought a product, it got boarded on the country of origin and by the time it reached the U.S. the regulations had changed. And so they're now faced with paying a very big amount of duties that they weren't prepared to do. And a lot of people have had their cargo stuck or just abandoned because they just couldn't handle the huge financial responsibility that came with that. That's one of the biggest things for my clients.

[00:06:44] Speaker A: An ever changing policy from the White House hasn't been the only headwind. Middle east and Black Sea wars, airspace closures, even the US government shutdown. It was a year when no one would have been surprised if we'd seen aviation slump. But trade, as ever, well, it finds a way.

[00:07:04] Speaker E: Yeah. So as we come to the end of 2025, I would actually sum up this year as being actually quite, quite successful for the industry. I think it's been extremely volatile, as we've mentioned earlier, with the tariffs and the more restrictive trading environment.

But the industry has responded with great agility. It's moved capacity to where it is needed. Demand flows have shifted. We've seen as a consequence of reduction of de minimis, particularly in the US where actually the de minimis rules have been removed. It's actually cut trade of E commerce coming from China to the US by about 50%. But almost overnight, e commerce flows from China to Europe have doubled. So we actually saw that capacity redeployed in very short notice. So that was a really good, strong testament to the flexibility and agility that this industry can demonstrate. What we have also seen though is trade flows within Southeast Asia change. So Vietnam, for example, is now the largest exporter of laptops to the US even though initial assembly is produced elsewhere in Asia. Final assembly is in Vietnam. We've also seen India, for example, first time, that is now the leading exporter of smartphones to the US Again as a consequence of shifting manufacturing throughout Asia and therefore the consequential change to supply chain. So the industry has held up very well.

[00:08:26] Speaker A: That theme, resilience in the face of chaos, was echoed by traders, forwarders, shippers and brokers we spoke to at Transport Logistics Americas in Miami in November.

[00:08:41] Speaker B: Actually, trade hasn't stopped. If anything, it's accelerated. I see clients pouring in like never before. So when people say, oh, this is going to stop trade, that's not my experience.

It has not stopped.

[00:08:54] Speaker A: And that was just as true for regional carriers that run operations in and out of the US that the Freight Buyers Club spoke to in Miami. Jaime Alvarez, director of cargo at Panama's.

[00:09:05] Speaker H: COPA Airlines we as a passenger airline we fly to 17 destinations in the U.S. multiple flights daily to some of the big cities and the latest actions on restrictions on small packages affected us. We were not prepared, nobody was. So the lack of knowledge and information stopped everything. It might come back. Some of it is coming back, but so far we still working on it and for next year, hopefully we'll see a better environment in that sense. Until now the operation has been going really well until now, except from these limitations. And we're growing and we provide a good service to Panama and we're happy to continue providing the best possible service in the region.

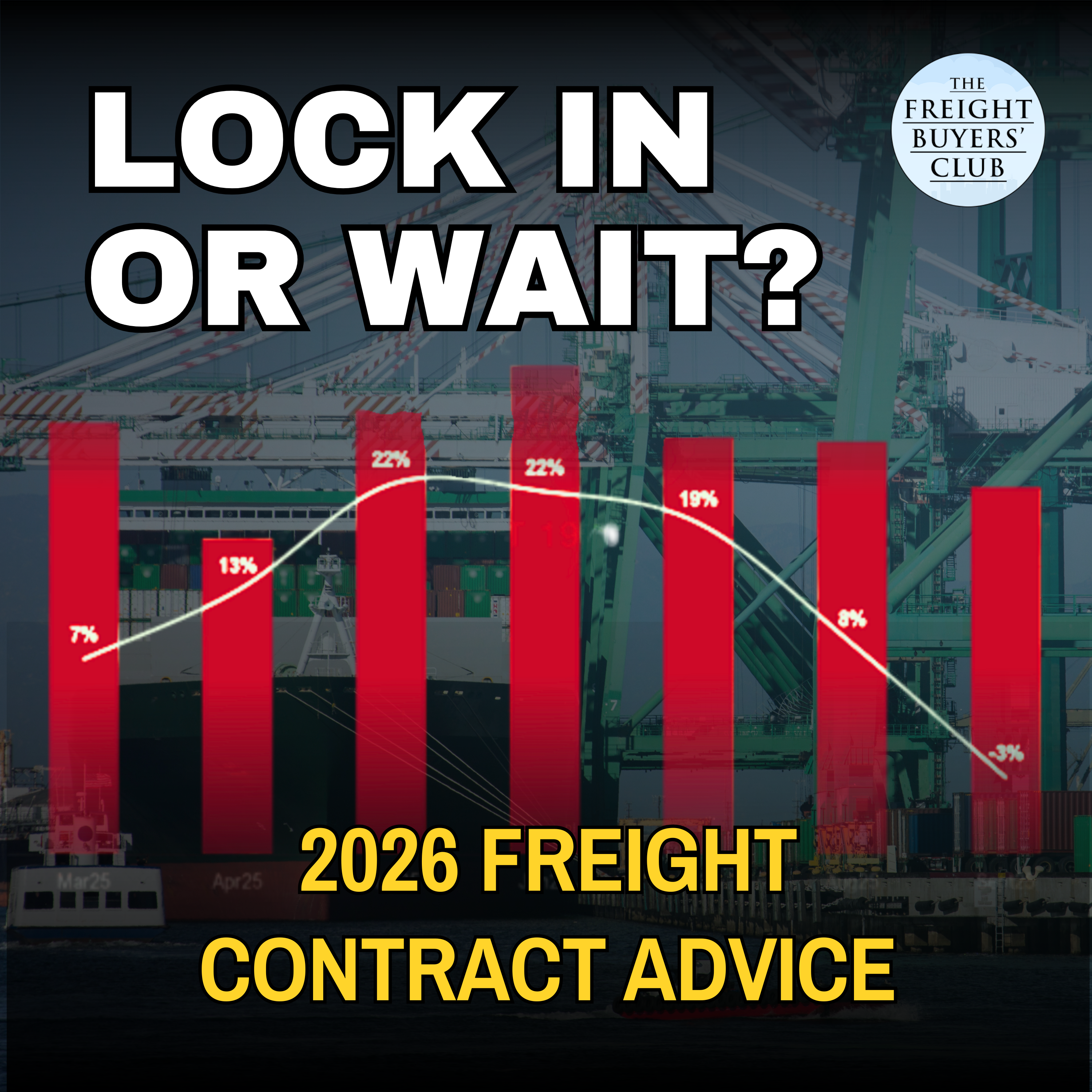

[00:09:58] Speaker A: So what's going on? Because despite all the doom laden forecasts for 2025, World ACD now expects global tonnage to grow 4% this year, driven by a 9% jump out of Asia Pacific and on the Big east west lanes, the shifts have been, well, eye opening, as you can see courtesy of World acd. In the year through October, shipments from China and Hong Kong to the US are down 6.41%. But from Southeast Asia into the US they are up by over 25%.

Meanwhile, while Chinese shipments to the US have fallen to Europe, they were up 8.42%. What we've seen, according to multiple sources, is that the unpredictability of tariffs and the end of de minimis exemptions force shippers and platforms to move fast, rerouting, sourcing, shifting origins and flying goods early to stay ahead of the rule changes. And freighter operators have responded. In short, when politics gets unpredictable, air freight becomes the quickest way to keep a business moving. Brandon Fried, executive director of the Air Forwarders association, said his members reported a mixed year. Some were busy, some not so busy. But the growth patterns they talk about really do match the patterns we're seeing in the data.

[00:11:10] Speaker F: Certainly in the South America, Asia and then of course into Europe, they're doing better again. It's pretty probably routes that don't involve the United States that are doing well at this point. And that's bringing global air freight numbers up and coming into the US It's a different story.

[00:11:30] Speaker A: We'll just take a short break. We'll be back with you in a second.

[00:11:33] Speaker G: This podcast is proudly produced in partnership with Demerco Express Group, a trusted provider of global shipping and contract logistics services in Asia, Europe and North America. DeMurco's particular strength is in Asia, where it gives shippers the freight capacity and local market expertise to streamline freight movements to and from the region, particularly for Trans Pacific lanes. With 130 forwarding and logistics locations across China, India and Southeast Asia, Demurco connects Asia with the world like no other. Global3PL. You are listening to the Freight Buyers Club.

[00:12:07] Speaker A: Nowhere is this adaptability more visible than at the two US Airports most tied to international trade, Anchorage and Miami. At mia, they expected tariff policy to knock volumes, but the numbers, well, they told a very different story. Over to Jimmy Narez, head of cargo.

[00:12:25] Speaker C: So most of us in the industry did expect that there would be some impacts, of course, but as we've gone through the year, at least for Miami International Airport, we realized that we were actually not impacted negatively. And on the contrary, our cargo volumes have actually grown. This year at Miami International Airport, we actually are about 13% higher in cargo volumes through September of 2025.

Part of the reason is, first of all, Miami International Airport is a major transit hub for air cargo. 49% of our cargo is in transit. So to some extent we are not as affected as many other airports around the world were, as many other US Airports, I should say, being that we are a transit hub. Another thing I think that we've seen in the air cargo industry is that we're quite resilient. We've all known this for quite some time.

But the route networks can be easily, relatively easily switched to take better advantage of other opportunities when tariffs become somewhat of a block. So yeah, I think the aviation industry has been very resilient. For example, even though most of the E commerce originates from China, we've seen a lot of rerouting. Now instead of leaving China, it's actually entering the US from Vietnam, for example, Southeast Asia. So again, this just shows how resilient the industry is and making adjustments to, you know, to navigate the changes, you know, in policy.

[00:13:52] Speaker A: And up in Anchorage, a critical Trans Pacific hub, the story was remarkably similar.

[00:13:58] Speaker D: What we've seen in Anchorage in particular is that flight volumes have remained robust.

The sector continues to thrive and as many are fond of saying, you know, air cargo thrives in chaos. And this has been a very tumultuous market where we're seeing record volumes through Anchorage through October, flight volumes for the carriers that we track. So it's everybody except for FedEx and UPS. Flight volumes are up 5% over a record year last year.

[00:14:27] Speaker A: So what's the outlook for 2026?

[00:14:29] Speaker E: TIAQA's Glyn Hughes we're expecting continued growth going into 2026.

Right now, we're at about 27 months worth of consecutive growth.

And the current projection is that that growth will continue certainly through the first half of next year.

[00:14:46] Speaker A: And even in the US despite the end of de minimis exemptions, MIA isn't expecting E commerce volumes to decline. Far from it.

[00:14:53] Speaker C: I still feel that the industry will remain strong next year. That will continue to have growth, and that is mainly because of the exponential growth of E commerce. Okay, right. Right now, about 20% of all. We estimate about 20% of all of our air cargo is represented by E commerce. And it's just been growing exponentially. In 2021, at MIA, we had about a million de minimis shipments, which are primarily e Commerce. In 2022, that jumped up to 25 million. 2023, about 75 million. So it's just growing exponentially. And this is not just at Miami International Airport. This is all around the world. So I think E commerce will continue to grow, and that's really going to help fuel growth for the entire aviation industry in the years to come.

[00:15:36] Speaker A: But it's not all sunshine. Let's talk about what the industry still wants and what's keeping people awake ahead of 2026.

[00:15:45] Speaker B: What people in my industry would like to see next year. And it's actually one of the things we took to Washington was give us a little bit of time before these regulations get implemented.

It helps us to become more prepared and to properly uphold regulations the way that we should when we are given enough time to assimilate it and figure out. And mostly systems, you know, because we run at the speed of light, we take advantage of technology. Our systems are good to go.

But the bigger system, which is the government, needs a little bit more time to get those systems up and running and everything work together cohesively to make sure that we're all doing what we got to do.

[00:16:24] Speaker A: Pair points were echoed by Brandon, who also sees risks beyond US borders. As we head into 2026, we need.

[00:16:30] Speaker F: To see some relaxation of these tariffs. And hopefully the administration here in the United States can work deals with these countries to make sure that trade flows more evenly into the U.S. but I think obviously the geopolitical issues are still out there. You know, we still have Ukraine, we still have concerns about what's going on in China, and recently, obviously close to here in Miami, we have concerns that are going on down in Venezuela. So that's a big concern.

[00:16:57] Speaker A: But Christmas is looming. So let's finish on a festive note, a reminder, if we may, of why free trade is worth fighting for.

[00:17:07] Speaker E: One of the premises that trade is based on is the free flowing of goods over borders. As borders become more complex, it adds cost, it adds time, and it actually dilutes the value of international trade. One of the interesting reports that the World bank has actually produced is since the early 90s and the rapid growth of the global economy at that stage, over 1 billion people, global citizens, have actually been elevated out of abject poverty into the middle classes. So open, free and fair trade is good. It's good for the globe, it's good for global prosperity and overall the global communities will benefit from continuance. So what we would like to see as TEACA is we would like to see all countries look at the value of trade not as a restrictive national concern, but more as part of a global community.

Everybody benefits from free and open trade, national economies, global economies and citizens of all countries.

[00:18:09] Speaker A: I do hope you enjoyed our take on the air cargo market produced with the kind support of the Americo Express Group. Plenty to watch, I think, in 2026. Huge thanks to Karen Ball and Tom Matthews for helping us bring this story together, and to you all for listening. Please do subscribe, follow and comment if you enjoy this content. I'm Mike King, this is the Freight Buyers Club. See you soon.